Article 51 of the UAE CT Law indicates that any Taxable Person should be registered for CT with the FTA within the timeline prescribed by the FTA and obtain a Tax Registration Number. The timeline has now been prescribed in FTA Decision No. 3 of 2024.

KEY HIGHLIGHTS

- Timeline for Resident Juridical Persons

For resident juridical person, incorporated or otherwise established or recognized prior to 1 March 2024, the month in which License is issued to the juridical person is an important factor (irrespective of the year of issuance). The timelines to submit the Tax Registration application shall be as per the below table:

Where a juridical person has more than one License, the License with the earliest issuance date shall be used.

For resident juridical person, incorporated or otherwise established or recognized on or after 1 March 2024, the timelines to submit the Tax Registration application shall be as per the below table:

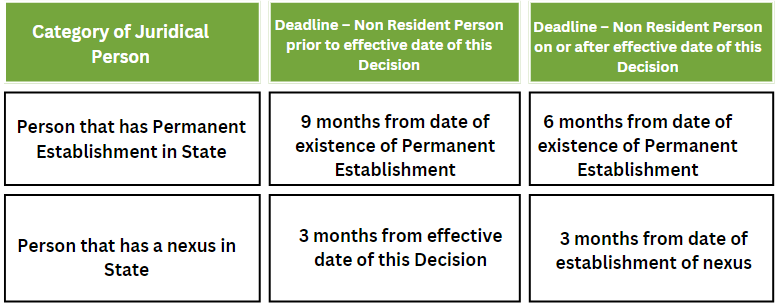

- Timeline for Non-Resident Juridical Persons

For a juridical person, that is a Non-Resident Person prior, on or after 1 March 2024, the timelines to submit the Tax Registration application shall be as per the below table:

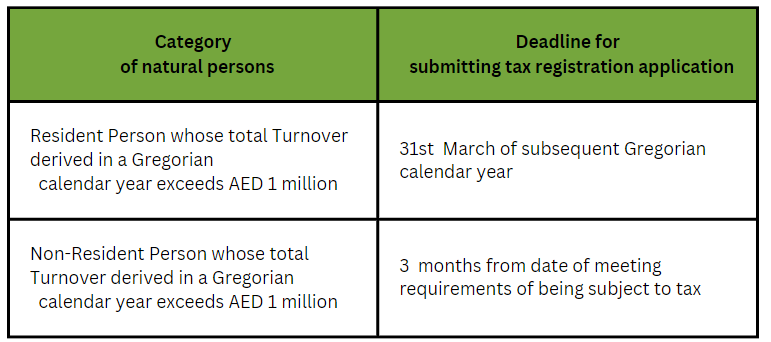

- Timeline for Natural Persons

A natural person whose total turnover in a Gregorian calendar year exceeds AED 1 million shall be subject to UAE corporate tax and shall be required to obtain corporate tax registration.

In case an individual is conducting a business or business activity within the UAE, the timelines to submit the Tax Registration application shall be as per the below table:

Late submission of corporate tax registration application

Taxable Persons that fail to submit the application for UAE Corporate Tax Law within the timelines stipulated by the FTA may face a penalty of AED 10,000.

If you need further assistance, please contact us [email protected] and call us +971 457 52971.

We have our expert Tax consultant to assist you!