Offshore companies are permitted to open a bank account in the UAE, however, they cannot issue work visas or have a physical office within the country. Offshore licenses are typically used as holding companies and are mainly incorporated for operations in foreign countries with financial, legal and tax benefit purposes. Offshore companies under free zones such as JAFZA and RAKICC can own real estate in the UAE.

- Low startup cost

- Speedy incorporation process

- 100% tax-free

- 100% foreign ownership permitted

- No paid-up share capital or audit requirement

- Multiple bank accounts

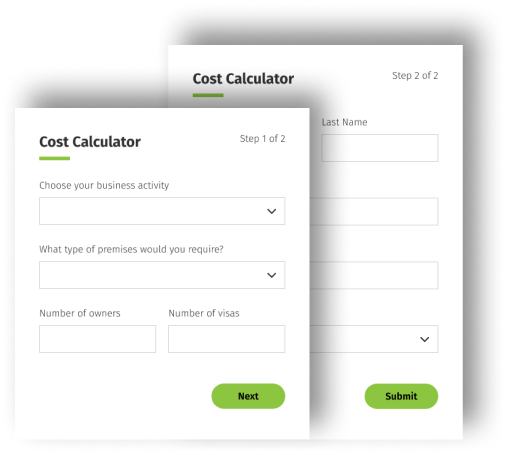

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

Given below are the key features of an offshore company in the UAE:

A minimum of one shareholder is required and corporate shareholders are permitted. International corporate shareholders are required to have company documents attested.

A minimum of one director is required and corporate directors are permitted. Details of directors are not available on the public register.

Every company must have a secretary. A company director may also act as a company secretary.

- Choose business activity

- Finalise company name

- Complete incorporation paperwork

- License issuance

- Open company bank account